PLG vs. SLG: The SaaS Growth Debate

If you spend any time on LinkedIn or Twitter, you’ve likely noticed an ongoing debate recently — PLG vs. SLG.

The debate boils down to scaling a sales team or letting your product do the talking. This is a false dichotomy (which we’ll get to in a bit).

The rise of PLG is about removing friction, which has been a constant theme in SaaS over the past three decades. But friction isn't always bad, which is why many SaaS leaders use a combination of PLG and SLG.

The goal of this post is to help you understand which approach is right for you: Product-Led Growth (PLG), Sales-Led Growth (SLG), or a combination of both.

Before we get there, let’s set the context for how PLG became a thing in the first place.

Where did SaaS come from?

Before the SaaS model, customers hosted and maintained software onsite. Cloud computing enabled vendors to host and maintain software in the cloud. This made life easier for customers and changed the economics of software.

- Before SaaS, software had to be physically installed on site. This led to large upfront payments, often with multi-year contracts.

- Since SaaS lives in the cloud, there's no need for physical installation. SaaS vendors also offer customers more flexibility with contracts, including shorter payment terms. Lower initial costs and easier onboarding helped power the rise of SaaS.

This dynamic also transformed software sales.

The Meaning of SLG

Sales-Led Growth is a growth strategy that primarily relies on a sales team to bring on new customers. When people talk about Sales-Led-Growth, they often mean an inside sales strategy. Inside sales entails selling products remotely rather than face-to-face.

Before SaaS, on-premise software companies employed outside sales teams. These sales reps would visit customers and do their selling face-to-face. This made sense given the physical installation and higher upfront costs mentioned above.

Further, before the internet, customers relied on sales reps for product education. Online search and videoconferencing technology made customers more comfortable purchasing software online.

Salesforce is credited as the first true SaaS company. They also invented modern inside sales org structure. At its simplest, an inside sales team typically consists of:

- Business Development Representatives (BDRs), who handle prospecting and book opportunities for Account Executives.

- Account Executives, who close deals.

- Levels of sales management, including Managers, Directors, and VPs of Sales.

Inside sales offers several benefits:

- No need to book travel or coordinate in-person meetings

- Sales hires don't need as much experience since they don't have to make in-person visits.

- Modern sales enablement tools, allow sales teams to scale outreach rapidly.

But there is still a drawback of a sales-led approach. For startups, hiring and scaling a sales team can be expensive.

As the SaaS market expanded, new players developed a new growth strategy. These companies offer a self-service model, allowing the product to sell itself.

The Rise of PLG

PLG was coined by OpenView's Blake Bartlett. He defines it as a growth strategy where the product itself acts as the primary driver of acquisition, retention, and expansion.

There’s much more to the rise of PLG than frustration with salespeople.

First, consumer apps raised customer expectations for digital experiences. Apps like Uber and OpenTable, that made mundane tasks simple, raised the bar for work apps.

Second, users grew frustrated with legacy SaaS apps. These employees started looking for new solutions to make their day-to-day easier.

Third, AWS made it cheaper and easier to start a SaaS company. This led to a massive new supply of SaaS startups. Many of which targeted individual users with a bottoms-up approach.

The visual below helps illustrate the extent of the SaaS explosion:

With so many new solutions to choose from, the rise of PLG was inevitable. Using a self-serve freemium model, PLG companies made it simple to get started. The hard part became building a product that customers could fall in love with. But if users did love the product, they could then spread it throughout the organization.

This is the essence of Product Led Growth.

PLG vs. SLG

The biggest difference between PLG and SLG is how each strategy gathers information from customers. Sales relies on direct conversations, while PLG uses product data.

One of the biggest benefits of Sales is that it forces interaction with the customer. Having real conversations with prospects and customers is an invaluable source of intel. These conversations can steer product, pricing, and go-to-market decisions

Another big benefit of Sales is that it tends to scale linearly, which means its predictable. The more reps you hire, the more revenue you are likely to generate. Sales leaders have gotten very good at modeling what will happen when they scale a team to various sizes.

So what’s wrong with Sales?

First of all, sales reps can be an expensive resource, especially relative to a pure PLG strategy.

Further, scaling an effective SaaS sales team often takes resources beyond headcount, including:

- Effective onboarding and training

- Ongoing coaching

- Sales enablement resources

- Sales operations resources

Even if you do that, your Sales team will still have the highest turnover of any department at your company.

Sales tends to be a magnet for young professionals that don't know what they want to do (guilty 🙋🏼♂️). That means lots of them realize that it’s not for them, and move on to something else.

There’s also the simple truth that many people would rather not talk to salespeople. Annoying cold calls and pushy sales experiences can ruin it for the rest of us. These reps can also tarnish a company’s reputation.

What about PLG?

The PLG model can deliver a digital experience that exceeds customer expectations. This is a huge benefit because it makes it more likely customers will like your brand and spread the word.

PLG also allows companies to catch users early in the buyer’s journey. The traditional sales process often takes time as both sides navigate a company-wide license. With PLG, a single user can get started right away, and spread the word throughout their organization.

PLG also opens the floodgates to tons of product usage data. By making customer onboarding seamless, PLG companies can track how ideal customers use their product. This can help answer several questions, including:

- Which features are most important?

- What does the typical user workflow look like?

- What should be prioritized on the product roadmap?

Lastly, PLG is a cheaper option than SLG since there's no need to fill Sales headcount.

So what could possibly go wrong?

The biggest drawback to PLG is it requires patience. Many users don't hold budget authority beyond an individual license. This means a bottoms up approach can take a long time to flower into an enterprise-wide agreement.

Further, product usage data is great, but it can come at the expense of customer interaction. Of course, this depends on the company, but it’s a true downside for some.

Another difference between PLG and SLG is how each impacts pricing.

How PLG and SLG Impact Pricing Strategy

SLG and PLG companies can have similar or very different pricing strategies. It's difficult to generalize across the SaaS landscape, but there are common trends.

In general, PLG companies allow users to limit their initial investment. This can include:

- Free trials

- Freemium plans

- Usage-based pricing

- Low-cost subscriptions for a limited users

As such, PLG companies are generally transparent with pricing. A customer can only purchase through self-serve if they know what it costs.

On the other end of the spectrum are enterprise SaaS companies with a pure SLG motion. Often, these companies don’t list their pricing, or have a pricing page at all for that matter. While critics may bash these companies for a lack of transparency, it makes sense.

Take Enterprise Resource Planning (ERP) solutions for example. Many of these firms offer customized solutions, often with different product modules. Without knowing which modules you need, this can get confusing on a pricing page. These companies send visitors straight to sales, who will help diagnose their needs.

To be clear, there’s a lot of room between pure PLG and pure SLG.

For instance, a company that relies primarily on sales may offer a free trial or a freemium version of their tool so users can get a feel for the product.

Alternatively, a PLG company may have a “Contact Us” form under their Enterprise plan. This pushes larger prospects to the sales team to navigate a company-wide deal.

This middle ground is where most SaaS companies are likely to end up. A big reason why is that some of the biggest players in SaaS have proven how well PLG and SLG can work together.

How PLG and SLG can work together

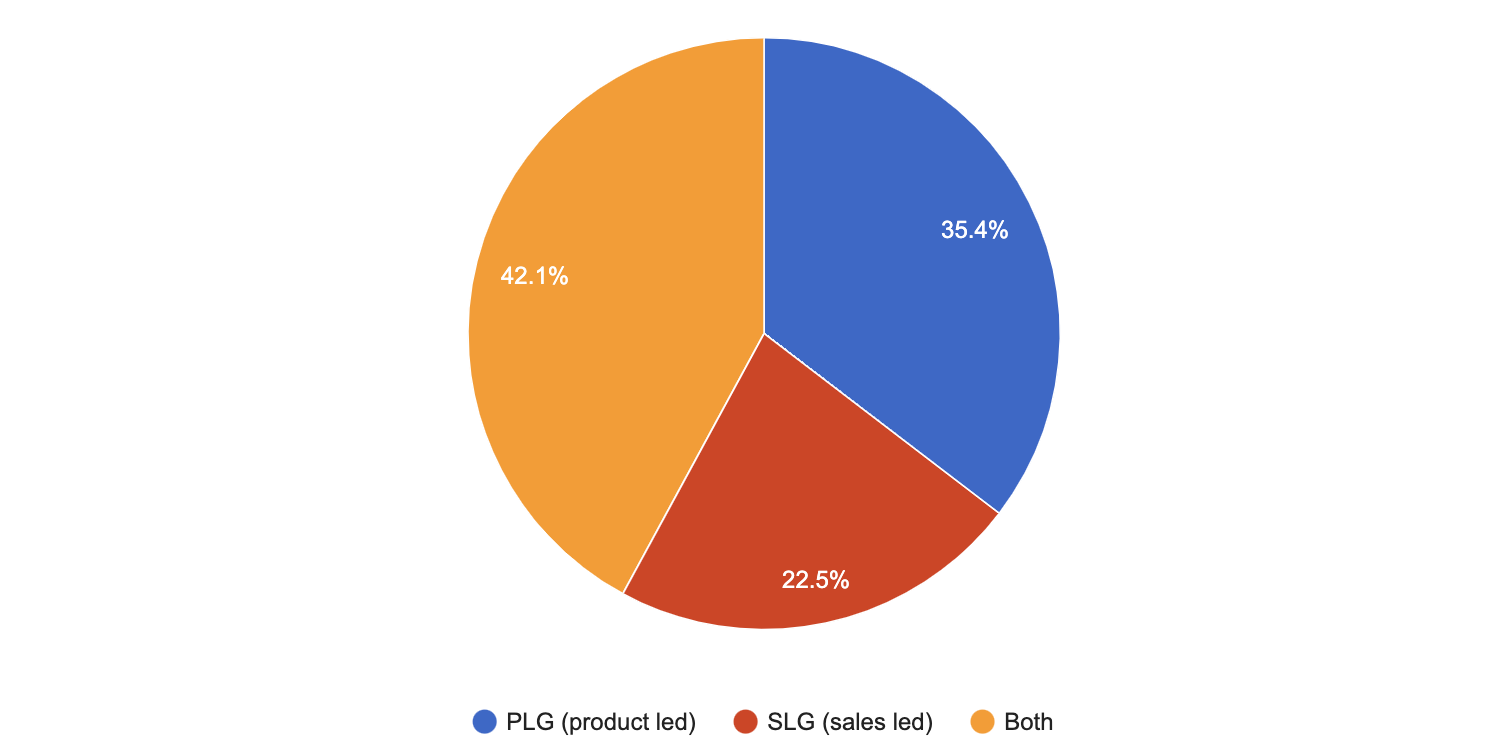

Even SaaS companies that started on the very end of spectrum have migrated to the middle. In fact, we’ve found the majority of SaaS companies already offer a combination of PLG and SLG.

Here are a few examples:

- Slack, initially a pure PLG play, now has a massive salesforce.

- Canva, one of the most successful PLG companies of all time, is building out a sales engine.

- Hubspot, originally a pure-SLG play, made SLG a focal point when launching its CRM.

- Snowflake, which offers usage-based pricing, also has a massive sales team.

But combining PLG with sales has its risks.

If a PLG company lets new sales hires loose on all their users, there will be many angry customers. Some users just aren't going to upgrade, no matter what.

One of the biggest reasons to layer sales on top of PLG is to consolidate accounts. This happens when users from the same company are using the product on separate licenses. This is a powerful approach and one of the first reasons a PLG company will hire salespeople.

While this is low-hanging fruit, if it’s the only way you’re deploying your sales team, you’re leaving money on the table.

Luckily, someone much smarter than me wrote a playbook to combine PLG and SLG

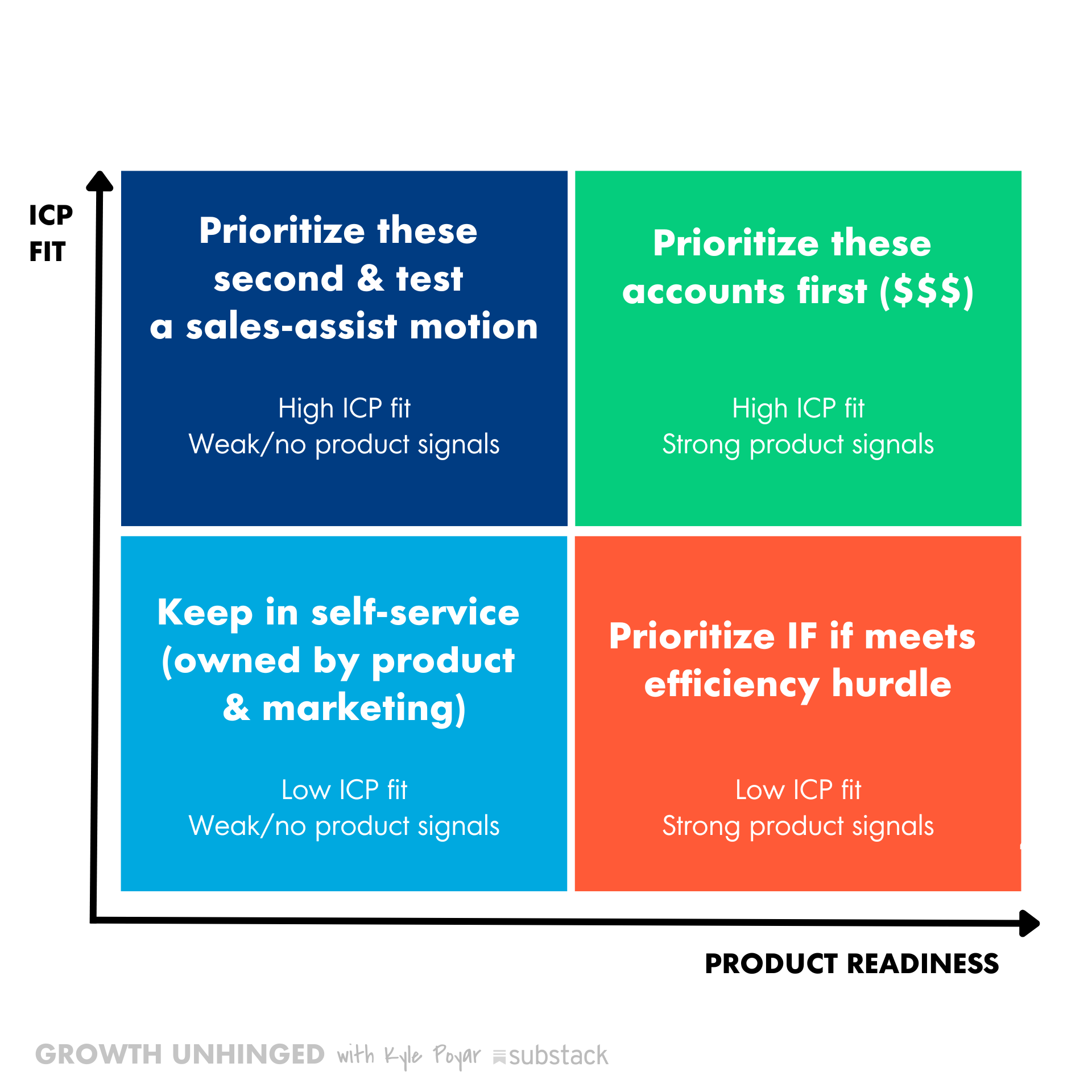

In his playbook, OpenView's Kyle Poyar breaks down when it makes sense to involve sales.

This approach entails doing two things very well:

- Defining your ideal customer profile

- Understanding which product triggers signal that a user is ready to talk to sales

Doing both of these things makes it easier for sales to prioritize accounts. It also keeps more customers happy.

Kyle mentions a couple other critical pieces to making this combination work:

- Sales incentives need to reward nurturing users along the customer journey.

- RevOps needs to be in lockstep with Sales incentives to avoid channel conflicts.

Here’s a common scenario of blending PLG and sales

A new user signs up for a product. The user talks to a salesperson, but isn't ready to buy. The salesperson nurtures the user along the customer journey. Then, one day, the user purchases through self-service.

This creates an interesting dilemma. Do you compensate the salesperson even if they didn’t technically close the deal? Or do you risk frustrating the salesperson by not rewarding their efforts?

This answer isn't always easy. Kyle recommends compensating the salesperson as long as they have legitimate involvement. The definition of legitimate involvement may vary, but I agree with this approach.

Blending these approaches successfully gives you the best of both worlds. PLG will help fill the CRM with qualified leads, and sales will shorten the sales cycle for larger deals.

Choosing the right Growth Strategy

Deciding between PLG, SLG, or both ultimately comes down to what kind of company you are. To illustrate, I’ll explore a few examples from personal experience.

In 2012, I started my career in SaaS as an outbound BDR on the Hubspot sales team. At that point, Hubspot’s sole offering was a marketing platform. While we offered a free trial, we didn’t have a self-service motion where users could purchase without talking to sales. We had a big BDR team, and lots of sales reps. We also had an incredible training program and ongoing coaching and education.

At that point, much of the sales process focused on educating prospects. Inbound marketing was a new idea, and it took time to get prospects comfortable with it. As a result, a PLG motion likely wouldn’t have been very effective.

Hubspot had also raised a $35m Series E round before I started. They had plenty of capital to spend on sales and supporting infrastructure. Armed with capital, and lots of smart people, Hubspot was able to grow market share rapidly. A decade later, Hubspot is considered one of, if not, the best marketing platform around.

After using SLG to grow Marketing Hub, Hubspot pivoted to a PLG for Sales Hub. The company has since rolled out PLG models across the full product suite. This proves that even with plenty of money in the bank, PLG is still a worthwhile strategy.

In 2017, I joined Litmus as one of the first sales hires. The company bootstrapped to tons of customers using PLG and a genius partner model. When I joined, Litmus had just raised $50M. A big reason for that was to build out a sales team. Between PLG and sales, the goal was to increase the average contract value of a customer.

Our sales team had two goals:

- Use product data to identify accounts with heavy usage

- Find big name brands on low-cost plans

During my time there, Litmus scaled the sales team from a handful of reps to a team of ~20-30. This is nowhere near the scale of Hubspot, but still quick growth considering I was only there for 18 months.

Lastly, I joined ProfitWell in 2018. I was hired as a Strategist, which is a blend of marketing consultant, account manager, and project manager (yes, a very cool job!).

ProfitWell bootstrapped (and remained so until getting acquired by Paddle for $200M+).

ProfitWell offers a number of products:

- Price Intelligently, a SaaS monetization solution which cost customers 6-figures per year

- ProfitWell, a free SaaS metrics platform

- Retain, a churn-reduction solution

Given the varying price points, we used different approaches for each product. We used SLG for Price Intelligently, PLG for ProfitWell, and a combination of PLG and SLG for Retain.

Importantly, we kept the sales team lean, with a handful of reps and BDRs supporting a product at any given time.

Given these experiences, here’s my take:

Unless it truly doesn't work for your product (e.g., ERPs), it always makes sense to leverage PLG to some extent. It will help fuel acquisition, monetization, and retention. Plus, it forces you to define your ideal customer, and understand product usage.

That said, I recommend having at least one person who owns sales, regardless of the scale of your company. It can even be in a part time capacity (as in, it's just one part of someone’s role).

Talking to users will allow this person to represent the "voice of the customer" during internal decisions. This perspective is critical when making decisions on product, pricing, and positioning. Sales also instills a sense of urgency that can energize the rest of the organization.

That said, you likely noticed a theme -- building a robust sales operation takes capital. As a result, the best model for your business depends on your resources. It also depends on the stage of your company, and your ultimate ambition. Not everyone wants to be a unicorn after all.